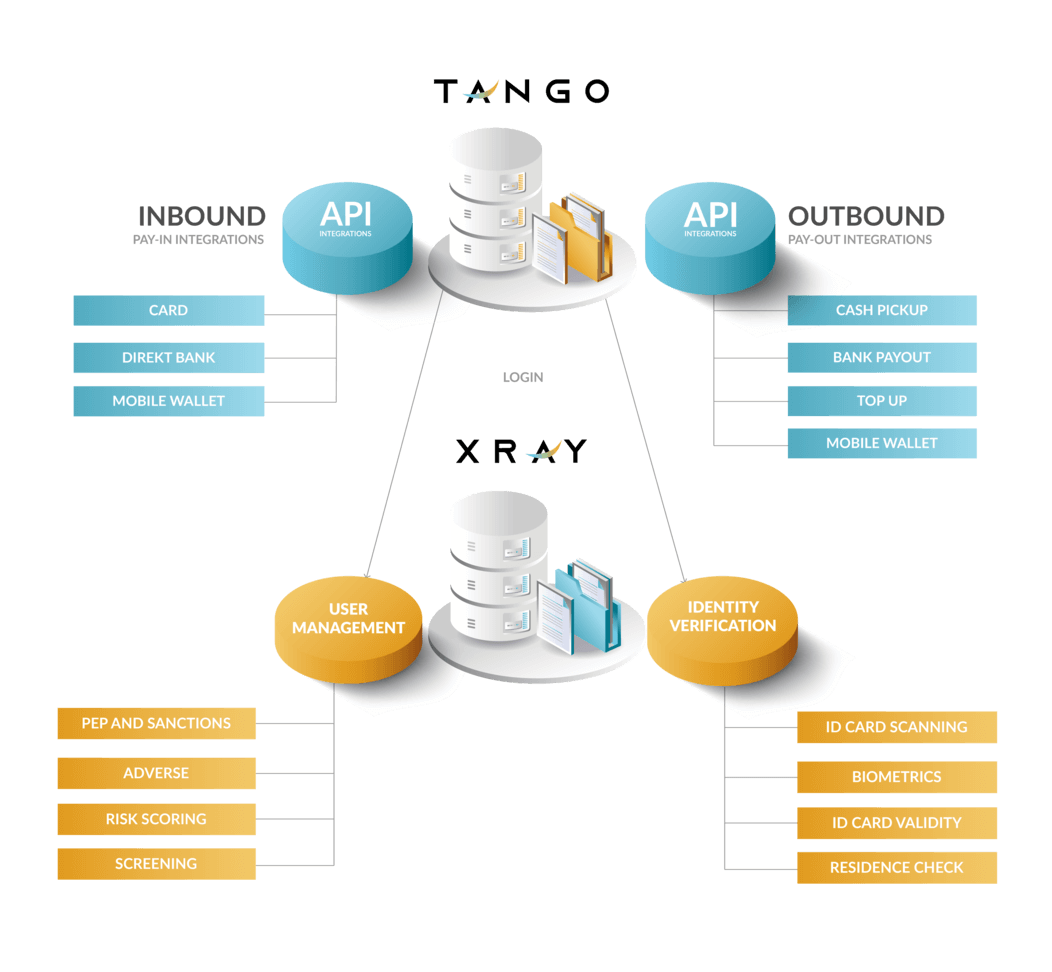

Solution Architecture

Our clients have the flexibility to choose the preferred payment partners for both the inbound (pay-ins) and outbound (payout).

It is designed for businesses within remittance and exchange industry to transfer money, collect data and to communicate it with third party software providers for AML and sanctions screening.

Tango AML Core System is the middle of the net, ensuring API communication between payment service providers on both ends, inbound and outbound.

The core system orchestrates the Anti-Money Laundering procedures, Know-Your-Customer, Politically Exposed Person checks, Sanctions Screening, IDs check, transfer limits and other “flags” serving your license compliance.

Partner with Tango AML to unlock growth opportunities and revolutionize cross-border remittance!

Business Compliance

AML6 and KYC centered CRM system for Financial Institutes. It ensured compliance with the local jurisdictions and Financial Supervisory Authority.

Monitoring

You know your customers and you can monitor changes. Tango facilitates, manages and recognizes patterns.

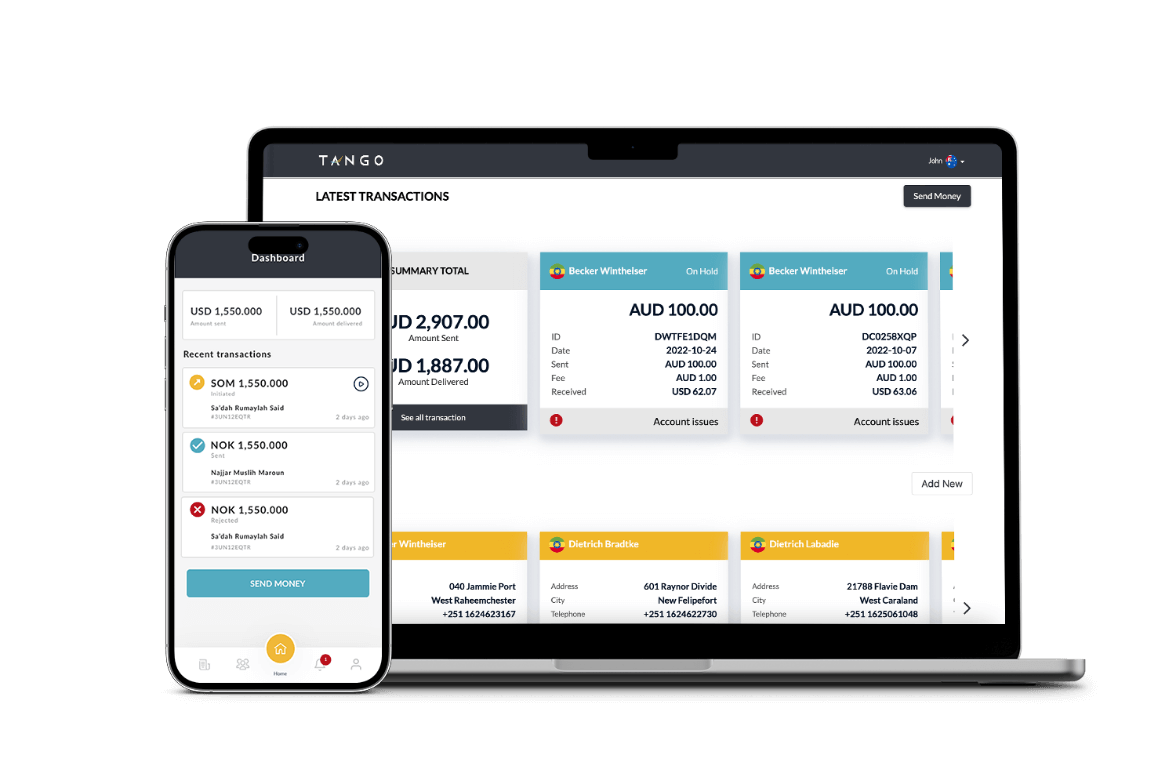

White label software

Sophisticated CRM for Remittance and Exchange companies. Branded & functional Money Transfer web/app ready to go to market.

Integrations

We integrate with direct bank and card gateways, Payment Service Providers across the globe.

Download your FREE Money Service Business Checklist

It's on its way! Please check your inbox in the next 5 minutes.

Something went wrong, please try again!

Why should Money Service Businesses use Tango AML software?

Tango AML software is built to serve the complete digital transfer across the value chain of a remittance from the sender to the beneficiary.

Therefore we have effective integrations tailored for financial services, precisely for the remittance sector, enabling API-driven business development. We support the fast and reliable integration of virtually any service to fulfill your business needs. We have an expert team that handles all the development and maintenance of integrations.

The core functionality

To run your business efficiently in accordance with the financial regulations, Tango offers a CRM module that keeps track of your clients and their relationship with the receivers. Further, a “reports maker” that helps you to export the list of remittances to any regulatory instance you have your license from.

Core System

The core is where we store all users, security, monitoring, rules around your corridors and it is equipped with integrated compliance, reporting, and customer support add-ons, offering a wide range of features and functionalities.

CRM

Customer Relationship Management: have full control and be prepared for any inspection.

AML

Anti-Money Laundering, - this is one of the most important things to keep in mind. Financial institutions can lose their bank accounts and/or licenses to remit money for AML reasons. Tango has a sophisticated flagging built in, as well as AML blacklist integrations with pattern recognition.

KYC

Do you have your own KYC protocols? Different protocols and processes for different countries? Tango ties your sender countries together with ID sources, internal and external. Making sure the person you are having business with is the person he/she says he/she is.

Reports

REPORTS Whatever you will be asked to provide, have full export possibilities.

Cloud-Based

Software platform that is cloud-based, offering the scalability and flexibility to be developed in Microsoft Azure or similar.

Compliance

Our AML, KYC solutions XRAY and Verifiero helps you stay in control of your KYC process, knowing who your client actually is and matches your compliance needs.

Customizable-Frontend

Front-end applications for iOS, Android, and web platforms, available for white-labeling to suit your specific branding needs.

Tango AML Solution

A reputation based in control, beyond reproach in regards to AML, Transaction Monitoring and Macro pattern recognition between services.

White-Label Money Transfer Software with AML6 and KYC centered CRM system for Financial Institutes.

Inbound, outbound integrations

Multiple user roles

CRM, ticketing, chat

AML flags

Personalized web & app design

Fees and FX set by the client

Corridors set-up

Report

Documents Verification Service Provider and AML Screening for regulatory compliance.

Liveness check

ID verification worldwide

PEP, Watchlist, Sanctions screening

Adverse Media

Behavioral patterns

AML monitoring

KYC & KYB verification

Tango AML Compliance

Tango helps MSBs focus on the right things, and these are the cases that stand out that are identified.

The smart build technology has the reporting, record keeping, flagging alerts, also facilitates, manages and recognizes micro and macro patterns already built in Tango AML software. The system flags behaviours, suspicious reports and its origin is, certain flags are kicked in on limitations the MSB's admins set up in accordance with the compliance process.

Secure Infrastructure

Flexible integrations

Real-time Risk Management

Multi-currency domains

Multi-corridor networks

Multiple transaction types

FX rates and fees management

KYC, AML sanctions screening

Ticketing control

TANGO AML SECURITY

Safe data storing

Tango is built to allow your end users to identify with government issued ID suppliers. To securely authenticate your clients, passing the information and storing it in safe places is the key architecture Tango was built on. Having a safe environment where your payments, behaviour and integrity is protected isn’t just important. It is everything.

Internal Security

We are delivering Tango to the isolated islands for each customer controlling the flow of data transportation much better. That way we do not only have high security implemented but also we are bringing the system much closer to your customers, lowering the latencies and speeding up the system. With using Tango you will have regularly upgraded the whole technology stack, adding new functionalities on a weekly basis, constantly tested against functional and security issues - where in case of issues we have fast recovery mechanisms.

External Security

Integrations are the part of every system, either you need to send a system notification email or make a money transaction, integrations are there to enable your system to do so. Tango is enabled with multiple integrations towards different services like inbound or outbound. Challenges in making integration secure and full functional is in complexity of the service we are using. Tango's approach is to integrate any service with the highest details possible.

Need a reliable technology partner?

Understanding which system is appropriate for your business is a demo away.